UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to § 240.14a-12 | |

QCR Holdings, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

3551 Seventh Street, Moline, IL 61265 Phone 309.736.3584 Fax 309.736.3149 |

April 8, 20207, 2022

Dear Stockholder:

On behalf of the boardBoard of directorsDirectors and management of QCR Holdings, Inc., we cordially invite you to attend the annual meeting of stockholders of QCR Holdings, Inc., to be held at 2:8:00 p.m.a.m., local time, on Wednesday,Thursday, May 20, 2020.19, 2022 (the “2022 Annual Meeting”). Due to the emergingongoing public health impact of the coronavirus outbreak (COVID-19) and to support the health and well-being of our employees and stockholders, the 20202022 Annual Meeting of Stockholders will be a completely “virtual meeting,” meaning that no part of the meeting will be hosted in-person. You will be able to attend the 2022 Annual Meeting, vote your shares electronically and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/QCRH2020.QCRH2022. You will need to have your 16-digit control number included on your Notice of Internet Availability of Proxy Materials (the “Notice”) or your proxy card (if you received a printed copy of the proxy materials) to join the 2022 Annual Meeting. Your virtual attendance at the 20202022 Annual Meeting will afford you the same rights and opportunities to participate as you would have at an in-person annual meeting, including the ability to ask questions during the meeting.

This year we are again using the Securities and Exchange Commission rule that allows us to furnish our proxy statement, 20192021 Annual Report and proxy card to stockholders over the internet. This means our stockholders will receive only the Notice containing instructions on how to access the proxy materials over the internet and vote online. If you receive the Notice but would still like to request paper copies of the proxy materials, please follow the instructions on the Notice or on the website referred to on the Notice. By delivering proxy materials electronically to our stockholders, we can reduce the costscost of printing and mailing our proxy materials. Please visit www.proxyvote.com for more information about the electronic delivery of proxy materials.

There are a number of proposals to be considered at the annual meeting.2022 Annual Meeting. Our stockholders will be asked to: (i) elect fourthree persons to serve as Class IIIII directors; (ii) approve, in a non-binding, advisory vote, the compensation of certain executive officers, which is referred to as a “say-on-pay” proposal; (iii) approve the QCR Holdings, Inc. 2022 Employee Stock Purchase Plan; and (iii)(iv) ratify the appointment of RSM US LLP as our independent registered public accounting firm for the year ending December 31, 2020.2022.

We recommend that you vote your shares for each of the director nominees and for all of the other proposals presented at the annual meeting.2022 Annual Meeting.

Regardless of whether you plan to attend the annual meeting,2022 Annual Meeting, you should vote by following the instructions provided on the Notice as soon as possible. This will assure that your shares are represented at the meeting.2022 Annual Meeting.

Very truly yours,

|   | |

| Marie Z. Ziegler | Larry J. Helling | |

| Chair of the Board | Chief Executive Officer |

3551 Seventh Street, Moline, IL 61265 Phone 309.736.3584 Fax 309.736.3149 |

NOTICE OF

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 20, 202019, 2022

To the Stockholders of QCR Holdings, Inc.:

The annual meeting of stockholders of QCR Holdings, Inc., a Delaware corporation, will be held virtually on Wednesday,Thursday, May 20, 2020,19, 2022, at 2:8:00 p.m.a.m., local time. You can attend the 2022 Annual Meeting online, vote your shares electronically and submit questions during the webcast. Instructions on how to attend and participate via the internet, including how to demonstrate proof of stock ownership, are posted on our meeting site at www.virtualshareholdermeeting.com/QCRH2020.QCRH2022. You will need to have your 16-digit control number included on your Notice of Internet Availability of Proxy Materials or your proxy card (if you received a printed copy of the proxy materials) to join the annual meeting.2022 Annual Meeting. The annual meeting2022 Annual Meeting will be held for the following purposes:

| 1. | to elect |

| 2. | to approve, in a non-binding, advisory vote, the compensation of certain executive officers, which is referred to as a “say-on-pay” proposal; |

| 3. | to approve the QCR Holdings, Inc. 2022 Employee Stock Purchase Plan; |

| 4. | to ratify the appointment of RSM US LLP as QCR Holdings, Inc.’s independent registered public accounting firm for the fiscal year ending December 31, |

| to transact such other business as may properly be brought before the meeting and any adjournments or postponements of the meeting. |

The Board of Directors has fixed the close of business on March 26, 2020,24, 2022, as the record date for the determination of stockholders entitled to notice of, and to vote at, the annual meeting.2022 Annual Meeting. In the event there is an insufficient number of votes for a quorum or to approve any of the proposals at the time of the annual meeting,2022 Annual Meeting, the meeting may be adjourned or postponed in order to permit the further solicitation of proxies.

By order of the Board of Directors,

Deborah M. Neyens

Corporate Secretary

Moline, Illinois

April 8, 20207, 2022

TABLE OF CONTENTS

| Page Number | ||||

| About the 2022 Annual Meeting | 2 | |||

| Proposal 1: Election of Directors | 7 | |||

| Nominees and Continuing Directors | 7 | |||

| Qualifications of our Board Members and Nominees | 8 | |||

| Corporate Governance and the Board of Directors | 12 | |||

| General | 12 | |||

| Committees of the Board of Directors | 13 | |||

| Consideration of Director Candidates | 15 | |||

| Board Diversity | 16 | |||

| Code of Business Conduct and Ethics | 16 | |||

| Board Leadership Structure | 16 | |||

| The Board’s Role in Risk Oversight | 17 | |||

| Environmental, Social and Governance Matters | 17 | |||

| Share Ownership and Retention Guidelines | 19 | |||

| Stockholder Communications with the Board, Nomination and Proposal Procedures | 19 | |||

| Our Executive Management Team | 20 | |||

| Security Ownership of Certain Beneficial Owners | 21 | |||

| Executive Compensation | 23 | |||

| Compensation Discussion and Analysis | 23 | |||

| Overview and Executive Summary | 23 | |||

| Objectives of Our Compensation Program | 24 | |||

| Elements of Compensation | 25 | |||

| Compensation Process | 28 | |||

| Analysis of | 30 | |||

| Regulatory Considerations | 33 | |||

| Insider Trading Policy | 33 | |||

| Anti-Hedging Policy | 33 | |||

| Anti-Pledging Policy | 34 | |||

| Clawback Policy | 34 | |||

| Share Ownership and Retention Guidelines | 34 | |||

| Compensation Committee Report | 34 | |||

| Summary of Compensation Paid to Named Executive Officers | 35 | |||

| Grant of Plan-Based Awards | 37 | |||

| Outstanding Equity Awards at Fiscal Year-End | 38 | |||

| Option Exercises and Stock Vested in | 39 | |||

| Pension Benefits | 40 | |||

| Potential Payments upon Termination or Change in Control | 41 | |||

| Compensation Committee Interlocks and Insider Participation | 45 | |||

| Pay Ratio | 45 | |||

| Director Compensation | 46 | |||

| Cash Compensation | 46 | |||

| Equity | Award Compensation | 47 | ||

| Proposal 2: Advisory (Non-Binding) Vote to Approve Executive Officer Compensation | 48 | |||

| Proposal 3: Approval of the QCR Holdings, Inc. 2022 Employee Stock Purchase Plan | 49 | |||

| Equity Compensation Plan Information | 53 | |||

| Proposal 4: Ratification of Selection of Independent Registered Public Accounting Firm | ||||

| 54 | ||||

| Section 16(a) Beneficial Ownership Reporting Compliance | 55 | |||

| Transactions with Management and Directors | 55 | |||

| Audit Committee Report | 55 |

1

| 1 |

PROXY STATEMENT

QCR Holdings, Inc., a Delaware corporation (“QCR Holdings”), is the holding company for Quad City Bank and Trust Company, Cedar Rapids Bank and Trust Company, Community State Bank and Springfield First CommunityGuaranty Bank. Quad City Bank and Trust is an Iowa state bank located in Bettendorf and Davenport, Iowa and in Moline, Illinois. Quad City Bank and Trust owns m2 Lease Funds,Equipment Finance, LLC, a Wisconsin limited liability company based in Milwaukee, Wisconsin, thatwhich is engaged in the business of leasing machinery and equipment to businesses under direct financing lease contracts. Cedar Rapids Bank and Trust is an Iowa state bank located in Cedar Rapids, Cedar Falls and Waterloo, Iowa. Community State Bank is an Iowa state bank located in Ankeny, Iowa and five other cities throughout the greater Des Moines area. Springfield First CommunityGuaranty Bank is a Missouri state bank located in Springfield, Missouri.Missouri and the southwest Missouri markets. On November 9, 2021, we announced the signing of a definitive agreement whereby we acquired Guaranty Federal Bancshares, Inc. (“GFED”) and merged Guaranty Bank, the wholly owned banking subsidiary of GFED, with and into Springfield First Community Bank. The transaction closed on April 1, and the combined bank now operates under the Guaranty Bank name in Springfield, Missouri and the southwest Missouri markets. When we refer to our “subsidiary banks” in this proxy statement, we are collectively referring to Quad City Bank and Trust, Cedar Rapids Bank and Trust, Community State Bank and Springfield First CommunityGuaranty Bank. When we refer to our “subsidiaries” in this proxy statement, we are collectively referring to our subsidiary banks, as well as our other subsidiaries.

This proxy statement is being furnished in connection with the solicitation by the boardBoard of directorsDirectors of QCR Holdings of proxies to be voted at the annual meeting of stockholders (the “2022 Annual Meeting”) to be held virtually on Wednesday,Thursday, May 20, 2020,19, 2022, at 2:8:00 p.m.a.m., local time, and at any adjournments or postponements of the meeting. This proxy statement and the accompanying form of proxy are first being transmitted or delivered to stockholders of QCR Holdings on or about April 8, 2020,6, 2022, together with our 20192021 Annual Report to stockholders.

About the 2022 Annual Meeting

The following, presented in question and answer format, is information regarding the meeting and the voting process, and is presented in a question and answer format.process.

Why did I receive access to the proxy materials?

We have made the proxy materials available to you over the internet because on March 26, 2020,24, 2022, the record date for the annual meeting,2022 Annual Meeting, you owned shares of QCR Holdings common stock. This proxy statement describes the matters that will be presented for consideration by the stockholders at the annual meeting.2022 Annual Meeting. It also gives you information concerning those matters to assist you in making an informed decision.

The board is asking you to give us your proxy. Giving us your proxy means that you authorize another person or persons to vote your shares of our common stock at the annual meeting2022 Annual Meeting in the manner you direct. If you vote using one of the methods described herein, you appoint the proxy holder as your representative at the meeting, who will vote your shares as you instruct, thereby assuring that your shares will be voted whether or not you attend the annual meeting.2022 Annual Meeting. Even if you plan to attend the annual meeting,2022 Annual Meeting, you should vote by proxy in advance of the meeting in case your plans change.

If you sign and return your proxy card or vote over the internet or by telephone and an issue comes up for a vote at the meeting that is not identified in the proxy materials, the proxy holder will vote your shares, pursuant to your proxy, in accordance with his or her judgment.

Why did I receive a notice regarding the internet availability of proxy materials instead of paper copies of the proxy materials?

We are using the Securities and Exchange Commission notice and access rule that allows us to furnish our proxy materials over the internet to our stockholders instead of mailing paper copies of those materials to each stockholder. As a result, beginning on or about April 8, 2020,6, 2022, we sent our stockholders by mail a notice containing instructions on how to access our proxy materials over the internet and vote online.This notice is not a proxy card and cannot be used to vote your shares. If you received a notice this year, you will not receive paper copies of the proxy materials unless you request the materials by following the instructions on the notice or on the website referred to on the notice.

2

| 2 |

Why are you holding a virtual meeting instead of a physical meeting?

Due to the emerging public health impact of the coronavirus outbreak (COVID-19) and to support the health and well-being of our employees and stockholders, our board of directors determined that it would be in the best interests of our stockholders for QCR Holdings to hold the annual meeting virtually rather than in person. We believe that hosting a virtual meeting will enable more of our stockholders to attend and participate in the meeting because it will limit contact with other individuals in light of COVID-19 concerns and it will allow our stockholders to participate from any location around the world with Internet access.

What matters will be voted on at the meeting?

You are being asked to vote on:

| 1. | the election of |

| 2. | a non-binding, advisory proposal to approve the compensation of certain executive officers, which is referred to as a “say-on-pay” proposal; |

| 3. | the approval of the QCR Holdings, Inc. 2022 Employee Stock Purchase Plan; and |

| the ratification of the selection of our independent registered public |

If I am the record holder of my shares, how do I vote?

You may vote by telephone, by internet, or by mail by completing, signing, dating, and mailing the proxy card you received in the mail, if you received paper copies of the proxy materials, or virtually during the meeting, as described further below. If you vote using one of the methods described above, your shares will be voted as you instruct.

If you sign and return your proxy card or vote over the internet or by telephone without giving specific voting instructions, the shares represented by your proxy card will be voted “for” all nominees named in this proxy statement and “for” each of the other proposals described in this proxy statement.

How can I vote my shares and participate at the annual meeting?

Stockholders may participate in the annual meeting by visiting the following website: www.virtualshareholdermeeting.com/QCRH2020. To participate in the annual meeting, you will need the 16-digit control number included on your notice or your proxy card (if you received a printed copy of the proxy materials). Shares held in your name as the stockholder of record may be voted electronically during the annual meeting. Shares held in the name of a broker or other fiduciary (i.e., in street name) also may be voted electronically during the annual meeting by following the instructions provided by your broker or other fiduciary. However, even if you plan to attend the annual meeting virtually, we recommend that you vote your shares in advance so that your vote will be counted if you later decide not to attend the annual meeting.

What will I need in order to attend the annual meeting2022 Annual Meeting virtually?

You are entitled to attend the virtual annual meeting only2022 Annual Meeting if you were a stockholder of record as of the record date for the annual meeting,2022 Annual Meeting, March 26, 2020, or you hold a legal proxy for the annual meeting.24, 2022. You may attend the annual meeting,2022 Annual Meeting, vote and submit a question during the annual meeting2022 Annual Meeting by visiting www.virtualshareholdermeeting.com/QCRH2020QCRH2022 and using your 16-digit control number to enter the meeting. Alternatively, you may simply login as a guest, which does not require a control number, but you will not have the opportunity to vote your shares or ask a question. If you are not a stockholder of record but hold shares in the name of a broker or other fiduciary (or what is typically referred to as “street name”), you should follow the instructions for attending the annual meeting2022 Annual Meeting provided by your broker or other fiduciary. IfHowever, even if you doplan to attend the 2022 Annual Meeting virtually, we recommend that you vote your shares in advance so that your vote will be counted if you later decide not comply withto attend the procedures outlined above,2022 Annual Meeting.

What will I need in order to attend the 2022 Annual Meeting virtually?

You are entitled to attend the virtual 2022 Annual Meeting if you were a stockholder of record as of the record date for the 2022 Annual Meeting, March 24, 2022. You may attend the 2022 Annual Meeting, vote and submit a question during the 2022 Annual Meeting by visiting www.virtualshareholdermeeting.com/QCRH2022 and using your 16-digit control number to enter the meeting. Alternatively, you may simply login as a guest, which does not require a control number, but you will not have the opportunity to vote your shares or ask a question. If you are not a stockholder of record but hold shares in the name of a broker or other fiduciary (or what is typically referred to as “street name”), you should follow the instructions for attending the 2022 Annual Meeting provided by your broker or other fiduciary. However, even if you plan to attend the 2022 Annual Meeting virtually, we recommend that you vote your shares in advance so that your vote will be admittedcounted if you later decide not to attend the 2022 Annual Meeting.

Online check-in will start approximately 15 minutes prior to the start of the meeting, which will begin promptly at 8:00 a.m. central time on May 19, 2022. The virtual annualmeeting platform is fully supported across browsers (Internet Explorer, Firefox, Chrome, and Safari) and devices (desktops, laptops, tablets, and cell phones) running the most updated version of applicable software and plugins. Participants should ensure that they have a strong Wi-Fi connection wherever they intend to participate in the meeting. Participants should also give themselves plenty of time to log in and ensure that they can hear streaming audio prior to the start of the meeting. A technical support number will be made available on the webpage during check-in for stockholders who experience technical difficulties accessing the virtual 2022 Annual Meeting.

How do I ask questions at the 2022 Annual Meeting?

To submit a question at the 2022 Annual Meeting, you will need to log into the meeting using your 16-digit control number. If you would like to submit a question, click on the “Q&A” button at the bottom of the screen, enter your question in the text box and click on “Submit” at any time during the 2022 Annual Meeting. You may also provide questions ahead of the 2022 Annual Meeting by emailing Kim Garrett, Vice President, Corporate Communications and Investor Relations Manager, at KGarrett@QCRH.com. We encourage you to submit any questions as soon as possible to ensure your questions are received.

| 3 |

Although you may vote by mail, we ask that you vote instead by internet or telephone, which saves us postage and processing costs.

You may vote by telephone by calling the toll-free number specified on your notice or by accessing the internet website referred to on your notice, each by following the preprinted instructions on your notice. If you submit your vote by internet, you may incur costs, such as cable, telephone and internet access charges. Votes submitted by telephone or internet must be received by 11:59 p.m. EDT on May 19, 2020.18, 2022. The giving of a proxy by either of these means will not affect your right to vote during the webcast if you decide to attend the annual meeting2022 Annual Meeting virtually.

3

If you want to vote during the live webcast of the annual meeting,2022 Annual Meeting, please follow the instructions for attending and voting at the meeting at the following website: www.virtualshareholdermeeting.com/QCRH2020.QCRH2022. Please note, however, that if your shares are held in the name of a broker or other fiduciary, you will need to arrange to obtain a legal proxy from that personshould follow the instructions for attending the 2022 Annual Meeting provided by your broker or entity in orderother fiduciary to vote during the live webcast of the meeting. Even if you plan to attend the annual meeting2022 Annual Meeting virtually, you should complete, sign, and return your proxy card, or vote by telephone or internet, in advance of the meeting just in case your plans change.

If I hold shares in the name of a broker or fiduciary, who votes my shares?

If you received access to these proxy materials from your broker or other fiduciary, your broker or fiduciary should have given you instructions for directing how that person or entity should vote your shares. It will then be your broker or fiduciary’s responsibility to vote your shares for you in the manner you direct.

Under the rules of various national and regional securities exchanges, brokers and fiduciaries generally may vote on routine matters, such as the ratification of the engagement of an independent public accounting firm, but may not vote on non-routine matters unless they have received voting instructions from the person for whom they are holding shares. The election of directors, the approval of the QCR Holdings, Inc. 2022 Employee Stock Purchase Plan, and the approval of non-binding advisory proposal on executive compensation are non-routine matters, and consequently, your broker or fiduciary will not have discretionary authority to vote your shares on these matters. If your broker or fiduciary does not receive instructions from you on how to vote on these matters, your broker or fiduciary will return the proxy card to us, indicating that he or she does not have the authority to vote on these matters. This is generally referred to as a “broker non-vote” and may affect the outcome of the voting on those matters.

We therefore encourage you to provide directions to your broker or fiduciary as to how you want your shares voted on all matters to be brought before the 2020 annual meeting.2022 Annual Meeting. You should do this by carefully following the instructions your broker gives you concerning its procedures. This ensures that your shares will be voted at the annual meeting.

2022 Annual Meeting.

A number of banks and brokerage firms participate in a program that also permits stockholders to direct their vote by telephone or internet. If your shares are held in an account at such a bank or brokerage firm, you may vote your shares by telephone or internet by following the instructions on their enclosed voting form. If you submit your vote by internet, you may incur costs, such as cable, telephone, and internet access charges. Voting your shares in this manner will not affect your right to vote during the annual meeting2022 Annual Meeting if you decide to attend the annual meeting virtually, however, you must first request a legal proxy from your broker or other fiduciary. Requesting a legal proxy prior to 11:59 pm EDT on May 19, 2020, will automatically cancel any voting directions you have previously given by internet or by telephone with respect to your shares.2022 Annual Meeting virtually.

What does it mean if I receive more than one notice card?

It means that you have multiple holdings reflected in our stock transfer records or in accounts with brokers. To vote all of your shares by proxy, please follow the separate voting instructions that you received for the shares of common stock held in each of your different accounts.

What if I change my mind after I vote?

If you hold your shares in your own name, you may revoke your proxy and change your vote at any time before the polls close at the meeting. You may do this by:

| · | signing another proxy with a later date and returning that proxy to us; |

| · | timely submitting another proxy via |

| · | sending notice that you are revoking your proxy to Shellee R. Showalter, SVP, Director of Investor Services, QCR Holdings, Inc., 3551 Seventh Street, Moline, Illinois 61265; or |

| · | voting during the live webcast of the meeting. However, simply attending the meeting will not, by itself, revoke your proxy. |

If you hold your shares in the name of your broker or through a fiduciary and desire to revoke your proxy, you will need to contact that person or entity to revoke your proxy.

4

| 4 |

How many votes do we need to hold the annual meeting?2022 Annual Meeting?

A majority of the shares that are outstanding and entitled to vote as of the record date must be cast at the annual meeting2022 Annual Meeting at which a quorum is present in order to hold the meeting and conduct business.

Shares are counted as present at the meeting if the stockholder either votes during the live webcast or has properly submitted a signed proxy card or other proxy.

On March 26, 2020,24, 2022, the record date, there were 15,853,46515,657,587 shares of common stock outstanding. Therefore, at least 7,926,7337,828,794 shares need to be present either by having logged in for the live webcast or by proxy at the annual meeting2022 Annual Meeting in order to hold the meeting and conduct business.

What happens if a nominee is unable to stand for election?

The board may, by resolution, provide for a lesser number of directors or designate a substitute nominee. In the latter case, shares represented by proxies may be voted for a substitute nominee. Proxies cannot be voted for more than the number of nominees presented for election at the meeting. The board has no reason to believe any nominee will be unable to stand for election.

What options do I have in voting on each of the proposals?

You may vote “for” or “withhold authority to vote for” each nominee for director. You may vote “for,” “against” or “abstain” on each of the other proposals described in this proxy statement and on any other proposal that may properly be brought before the meeting.

How many votes may I cast?

You are entitled to cast one vote for each share of stock you owned on the record date.

How many votes are needed for each proposal?

Our directors are elected by a plurality of the votes of the shares present in person or by proxy and entitled to vote and the fourthree individuals receiving the highest number of votes cast “for” their election will be elected as Class IIIII directors of QCR Holdings. A “withhold authority to vote for” and broker non-votes will have no effect on the election of any director at the annual meeting.2022 Annual Meeting.

Approval of the say-on-pay proposal, the QCR Holdings, Inc. 2022 Employee Stock Purchase Plan, the ratification of the appointment of RSM US LLP as our independent registered public accounting firm and, in general, any other proposals must receive the affirmative vote of a majority of the shares present in person or by proxy at the meeting and entitled to vote. Abstentions will have the effect of voting against these proposals. On all matters, broker non-votes will not be counted as entitled to vote but will count for purposes of determining whether or not a quorum is present.

Because the ratification of the say-on-pay is advisory, the outcome of such vote will not be binding on the board of directors.

Please remember that the election of directors, the QCR Holdings, Inc. 2022 Employee Stock Purchase Plan and the non-binding, advisory proposal on executive compensation are each considered to be non-routine matters. As a result, if your shares are held by a broker or other fiduciary, it cannot vote your shares on these matters unless it has received voting instructions from you.

Where do I find the voting results of the meeting?

If available, we will announce voting results during the webcast of the annual meeting.2022 Annual Meeting. The voting results will also be disclosed on a Form 8-K that we will file within four business days of the annual meeting.2022 Annual Meeting.

Who bears the cost of soliciting proxies?

We will bear the cost of soliciting proxies. In addition to solicitations by mail, officers, directors, or employees of QCR Holdings or of our subsidiaries may solicit proxies in person or by telephone. These persons will not receive any special or additional compensation for soliciting proxies. We may reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to stockholders.

| 5 |

What is householding?

The Securities and Exchange Commission has issued rules regarding the delivery of proxy statements and information statements to households. These rules spell out the conditions under which annual reports, information statements, proxy statements, prospectuses and other disclosure documents of a particular company that would otherwise be mailed in separate envelopes to more than one person at a shared address may be mailed as one copy in one envelope addressed to all holders at that address (i.e., “householding”). To conserve resources and reduce expenses, we consolidate materials under these rules when possible.

5

However, because we are using the Securities and Exchange Commission notice and access rule for the annual meeting,2022 Annual Meeting, we will not household our proxy materials or notices to stockholders of record sharingwho share an address. This means that stockholders of record who share an address will each be mailed a separate notice of the proxy materials. However, certain brokerage firms, banks, or similar entities holding our common stock for their customers may household proxy materials or notices. Stockholders sharingwho share an address and whose shares of our common stock are held in street name should contact their broker if they now receive: (i) multiple copies of our proxy materials or notices and wish to receive only one copy of these materials per household in the future; or (ii) a single copy of our proxy materials or notice and wish to receive separate copies of these materials in the future. If at any time you would like to receive a paper copy of our Annual Report or proxy statement, please write to Shellee R. Showalter, SVP, Director of Investor Services at QCR Holdings, Inc., 3551 Seventh Street, Moline, Illinois 61265, or call us at (309) 736-3584.

6

| 6 |

PROPOSAL 1:

ELECTION OF DIRECTORS

Nominees and Continuing Directors

Our directors are divided into three classes having staggered terms of three years. At the annual meeting,2022 Annual Meeting, stockholders will be asked to elect fourthree Class IIIII directors for a term expiring in 2023.2025. The board has considered and nominated three of the incumbent directors to serve as Class IIIII directors of QCR Holdings, and has nominated one new individual. Michael L, Peterson,Holdings. Patrick A. Baird, a Class IIIII director since 2013, and George T. Ralph, a Class III director since 2015,2010, informed the board that theyhe would not seek re-election as directors of QCR Holdings at the meetingreelection for an additional term, and, accordingly, the board did not re-nominate themhim for election.election at this year’s meeting. As a result, their directorshipshis directorship will end at the 2020 annual meeting of stockholders,2022 Annual Meeting, and the size of the board will be reduced from 12 to 11 directors as of the date of the annual meeting.directors. The board expresses its sincere thanks to Messrs. Peterson and Ralph for theirMr. Baird for his many years of dedicated service.

We have no knowledge that any of the nominees will refuse or be unable to serve, but if any of the nominees becomes unavailable for election, the holders of the proxies reserve the right to substitute another person of their choice as a nominee when voting at the meeting. Set forth below is information concerning the nominees for election and for each of the other persons whose terms of office will continue after the meeting, including age, year first elected as a director of QCR Holdings and all positions and offices held by the director with QCR Holdings. Directors are elected by a plurality of the votes of the shares present in person or by proxy and entitled to vote, and the fourthree individuals receiving the highest number of votes cast for“for” their election will be elected as Class IIIII directors.Our board of directors unanimously recommends that you vote your shares “FOR” all of the nominees for directors.

| ||

| Name – (Age) | Director Since | Positions with QCR Holdings and Subsidiaries |

| NOMINEES | ||

Director of QCR Holdings; Director of Cedar Rapids Bank and Trust | ||

| Larry J. Helling | 2001 | Chief Executive Officer and Director of QCR Holdings; Chief Executive Officer and Director of Cedar Rapids Bank and Trust; |

| Mark C. Kilmer | 2004 | Director of QCR Holdings; Chair of the Board and Director of Quad City Bank and Trust |

| Name - (Age) | Director Since | Positions with QCR Holdings and Subsidiaries |

| CONTINUING DIRECTORS | ||

| CLASS III (Term Expires 2023) | ||

James M. Field – (Age 59) | 2019 | Vice Chair of the Board and Director of QCR Holdings; Director of Quad City Bank and Trust |

| John F. Griesemer – (Age 54) | 2022 | Director of QCR Holdings; Director of Guaranty Bank |

| Elizabeth S. Jacobs – (Age 65) | 2020 | Director of QCR Holdings; Director of Community State Bank |

| Marie Z. Ziegler – (Age 64) | 2008 | Chair of the Board and Director of QCR Holdings; Director of Quad City Bank and Trust; Director of m2 Equipment Finance |

| CLASS I (Term Expires 2024) | ||

| Mary Kay Bates – (Age 62) | 2018 | Director of QCR Holdings |

| John-Paul E. Besong – (Age 68) | 2015 | Director of QCR Holdings |

| Todd A. Gipple – (Age 58) | 2009 | President, Chief Operating Officer/Chief Financial Officer and Director of QCR Holdings; Director of Quad City Bank and Trust; Director of Guaranty Bank |

| Donna J. Sorensen – (Age 72) | 2009 | Director of QCR Holdings; Director of Cedar Rapids Bank and Trust |

7

| 7 |

All of our continuing directors and nominees will hold office for the terms indicated, or until their earlier death, resignation, removal, disqualification, or ineligibility due to exceeding age eligibility requirements (a person who has reached the age of 72 before the date of the annual meeting2022 Annual Meeting is not eligible for election to the board), and until their respective successors are duly elected and qualified. AllUnless otherwise provided in their employment agreements, all of our executive officers hold office for a term of one year. ThereOther than such employment agreements, there are no arrangements or understandings between any of the directors, executive officers, or any other person pursuant to which any of our directors or executive officers have been selected for their respective positions.

Mr. Besong is director of United Fire Group, Inc., a company subject to the reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Mr. Baird is director of FGL Holdings, a company subjectPrior to the reporting requirementsmerger of GFED with and into QCR Holdings, Mr. Griesemer served on the Exchange Act.board of directors of GFED. No other nominee or continuing director has been a director of another company subject to the reporting requirements of the Exchange Act within the past five years.

Qualifications of our Board Members and Nominees

Descriptions of each director’s business experience during the past five years or more, as well as their qualifications to serve on the board, are as follows:

Patrick S. Bairdis the retired President and Chief Executive Officer of AEGON USA, LLC, the U.S. subsidiary of the AEGON Insurance Group, a leading multinational insurance organization. Mr. Baird joined the AEGON USA companies in 1976, and during his career also served as Executive Vice President and Chief Operating Officer, Chief Financial Officer and Chief Tax Officer. He is a graduate of the University of Iowa and is a Certified Public Accountant (inactive). Mr. Baird is a Commissioner for the Eastern Iowa Airport and is a founding board member and Treasurer of the Zach Johnson Foundation. He is also a director of Lombard International, a specialty life insurance company based in London, and a board member of FGL Holdings, a retail annuity and life insurance company based in the Cayman Islands. We consider Mr. Baird to be a qualified candidate for service on the board due to his experience as the President and Chief Executive Officer of a successful insurance company in Cedar Rapids, Iowa, one of our market areas, and due to his knowledge of the business community in this area and his broad financial acumen.

Mary Kay Bates is President and Chief Executive Officer of Bank Midwest, a regional community bank and financial services company based in Spirit Lake, Iowa, that provides banking, insurance, and wealth management services through an 11-branch network located throughout Northwest Iowa, Southwest Minnesota, and Sioux Falls, South Dakota. Ms. Bates’ career in community banking has spanned over 2530 years and, since joining Bank Midwest in 1995, she has gained a broad range of experience in lending, marketing, audit/risk, human resources, and operations. As an executive leader of Bank Midwest for the past 15 years, her responsibilities progressively increased to strategic initiatives that have included acquisitions and growth strategies, operational effectiveness, and workforce engagement. Ms. Bates currently serves on the boardBoard of directorsDirectors for Bank Midwest and Goodenow Bancorporation. She serves as a committee member on the CDIAC of the Federal Reserve Bank of Chicago, is a TrusteePast Chair of the Graduate School of Banking at Colorado and is a board directorChair Elect for the Iowa Bankers Association. She is also a Trustee of Lakes Regional Healthcare. Ms. Bates is recognized as an active community leader and volunteer, having served as a director and officer on multiple boards to enrich the quality of life and economic development within her community. In 2019, Ms. Bates was recognized as Banker of the Year by BankBeat Magazine. She attended Iowa State University and graduated with honors from the Graduate School of Banking at Colorado. We consider Ms. Bates to be a qualified candidate for service on the board due to her extensive knowledge of the banking industry that she has attained as the President and Chief Executive Officer of Bank Midwest.

8

John-Paul E. Besongis a former Senior Vice President of e-Business and Chief Information Officer for Rockwell Collins, a Fortune 500 company based in Cedar Rapids, Iowa, that provides aviation electronics for both commercial and military aircraft. He was appointed Senior Vice President and Chief Information Officer in 2003. Beginning in 1979, when he joined Rockwell Collins as a chemical engineer, Mr. Besong held management roles having increasingly more responsibility within the company, including vice presidentVice President of e-Business and Lean ElectronicsSM, headHead of the SAP initiative and Director of the Printed Circuits and Fabrication businesses. Mr. Besong serves on the boards of directors of United Fire Group, Inc., Junior Achievement (Cedar Rapids area), Mercy Medical Center, Iowa Public Television Foundation, andthe Technology Association of Iowa (TAI) CIO Advisory Board and is a former director of Lean Aerospace Initiative (LAI). He also serves as a member and former chair of the executive board of TAI. We consider Mr. Besong to be a qualified candidate for service on the board and the committees he is a member of due to his business acumen and distinguished management career as an officer and information technology expert of a Fortune 500 company.

| 8 |

Brent R. Cobb is Chief Executive Officer of World Class Industries. Mr. Cobb joined World Class Industries in May 2002 as Vice President, subsequently being named President in 2005 and Chief Executive Officer in 2019. Concurrently, Mr. Cobb is Chairman of Morton Industries, a global leader in tube fabrication for global equipment manufacturers. Active in the community, he is a past chair of the Greater Cedar Rapids Community Foundation and the founding board chair of the Hiawatha Economic Development Corporation. Additionally, Mr. Cobb is involved in YPO Iowa and is a former Chapter Chair. Currently he sits on John Deere’s Direct Material Supplier Council. We consider Mr. Cobb to be a qualified candidate for service on the board due to his knowledge and experience gained through his various roles at World Class Industries, in addition to his leadership roles in the Cedar Rapids, Iowa area, one of our markets.

James M. Fieldis a retired President and Chief Financial Officer of Deere & Company. During his 27 years with John Deere, he served as President of Worldwide Construction & Forestry and Power Systems, a position he has held since January 2019.President of Worldwide Agricultural Turf Division and President of Worldwide Commercial and Consumer Equipment Division. In addition, Mr. Field joinedhas also served as Deere & Company in 1994Company’s Chief Financial Officer and hasits Principal Accounting Officer and held a number ofseveral additional positions in the areas of accounting, treasury, and business development, and planning. He served as Chief Financial Officer of Deere & Company's former Timberjack Group (now integrated into the company’s forestry business), and was responsible for all accounting, finance, and treasury functions. He was appointed Comptroller, Deere & Company, in 2001, and Vice President and Comptroller, Deere & Company, in 2002. Mr. Field was named President of the former Commercial & Consumer Equipment Division in 2007. In 2009, he was named Senior Vice President and Chief Financial Officer for Deere & Company. In 2012, Mr. Field was named President, Agriculture & Turf Division and was responsible for sales and marketing in Americas and Australia and operations for Global Crop Harvesting and Turf & Utility Platforms. Before joining Deere & Company, Mr. Field served in a number of assignments at Deloitte & Touche. Mr. Field is a graduate of Western Michigan University and holds a CPA.Certified Public Accountant designation. He has completed Executive Education at theDartmouth’s Tuck School of Business, at Dartmouth and is a member of the Executive Committee for the John Deere Classic and serves on the Board of Directors for Hand in Hand and the Board of Trustees for St. Ambrose University. We consider Mr. Field to be a qualified candidate for service on the board due primarily to thehis knowledge and experience regarding public companies that he has gained in his various roles at Deere & Company.Company as well as the financial and investment banking perspective he brings.

Todd A. Gipple is a Certified Public Accountant (inactive) and began his career with KPMG Peat Marwick in 1985. In 1991, McGladrey & Pullen acquired the Quad Cities practice of KPMG. Mr. Gipple was named Tax Partner with McGladrey & Pullen in 1994 and served as the Tax Partner-in-Charge of the firm’s Mississippi Valley Practice and as one of five Regional Tax Coordinators for the national firm. He specialized in Financial Institutions Taxation and Mergers and Acquisitions throughout his 14-year career in public accounting. He joined QCR Holdings in January of 2000 and currently serves as the President, Chief Operating Officer and Chief Financial Officer.Officer of QCR Holdings. Mr. Gipple currently serves on the boardBoard of directorsDirectors of the John Deere Classic and on the Audit Committee for the Community Foundation of the Great River Bend and is the ChairPast-Chair of the Board of Directors for the Scott County Family YMCA.YMCA of the Iowa Mississippi Valley. Mr. Gipple previously served on the Board of Directors and the Executive Committee of the Davenport Chamber of Commerce, United Way of the Quad Cities, SAL Family and Community Services and the Scott County Beautification Foundation and was a member of the original governing body for the Quad Cities “Success by 6” Initiative.initiative. Mr. Gipple was the 2016 Chief Corporate Chair for the Quad Cities JDRF One Walk. We consider Mr. Gipple to be a qualified candidate for service on the board due to his experience as the President, Chief Financial Officer and Chief Operating Officer of QCR Holdings and his prior experience as a tax partner in public accounting. Mr. Gipple brings extensive business and banking experience to the board and enhances the board’s overall understanding of QCR Holdings’ and the banking industry.

John F. Griesemer has been President and Chief Executive Officer of Erlen Group since 2017 and a member of the Board of Directors of the Erlen Group since 1993. The Erlen Group is a privately-held family of industrial companies, including Springfield Underground, Westside Stone, and Joplin Stone. Mr. Griesemer holds a B.S. degree in Industrial Management and Engineering from Purdue University. He is the past Chairman and current member of the Board of Directors of Mercy Springfield Communities, member of the Springfield Catholic Schools Board of Directors and a member of the Board of Directors of the National Stone Sand and Gravel Association. He is a past member of the Board of Directors of the Missouri Limestone Producers Association, Catholic Campus Ministries, Junior Achievement of the Ozarks, and Ozark Technical Community College Foundation. We consider Mr. Griesemer to be a qualified candidate for service on the board due to his strong organizational and leadership background, management experience and deep ties in the Springfield, Missouri community, one of our market areas, and his service on the boards of directors of GFED and the banking subsidiary of GFED, Guaranty Bank.

| 9 |

Larry J. Helling was previously the Executive Vice President and Regional Commercial Banking Manager of Firstar Bank in Cedar Rapids with a focus on the Cedar Rapids metropolitan area and the Eastern Iowa region. Prior to his six years with Firstar Bank, Mr. Helling spent 12 years with Omaha National Bank. He joined QCR Holdings in September of 2001 as President and Chief Executive Officer of Cedar Rapids Bank and Trust and was appointed Chief Executive Officer Elect of QCR Holdings in November 2018. Mr. Helling is a graduate of the Cedar Rapids Leadership for the Five Seasons program and currently serves on the Board of Trustees of the United Way of East Central Iowa and Junior Achievement, as well as the Board of Directors of the Entrepreneurial Development Center and the Brucemore National Trust Historic Site. He is past President and a member of the Rotary Club of Cedar Rapids. We consider Mr. Helling to be a qualified candidate for service on the board due to his experience as the President of Cedar Rapids Bank and Trust, his past experience as an executive officer of Firstar Bank, located in Cedar Rapids, Iowa, one of our market areas, and his prior banking experience. Mr. Helling brings extensive business experience to the board and enhances the board’s overall understanding of QCR Holdings and the banking industry.

9

Elizabeth “Libby” Jacobs is President of The Jacobs Group, LLC, a Des Moines-based consulting firm specializing in the energy and regulated utilities industries, focused on business development, strategic communications, and public and regulatory policy. Ms. Jacobs formerly served on the Iowa Utilities Board, including four years as Chair. Previously, she had a 20-year career with the Principal Financial Group serving as Community Relations Director for the last 14 years of her career. In addition, Ms. Jacobs served seven terms in the Iowa House of Representatives, and was elected by her peers to serve seven years as Majority Whip. She has received numerous awards and honors, including the 2008 West Des Moines Citizen of the Year, 2008 Greater Des Moines Leadership Institute Business Leadership Award, and selection as a 2001 Des Moines Business Record Woman of Influence. Currently Ms. Jacobs is Vice Chair of the Mid-Iowa Health Foundation Board of Directors and also serves on the Board of Directors of Goodwill Industries of Central Iowa and serves on the Board of Directors of the Taxpayers Association of Central Iowa. She has served in leadership positions on nonprofit boards in the Des Moines area as well as regionally and nationally. Ms. Jacobs earned her bachelorBachelor of arts,Arts, with distinction, in political science from the University of Nebraska-Lincoln and her Master of Public Administration from Drake University. We consider Ms. Jacobs to be a qualified candidate for service on the board due to her public company experience, as well as her community involvement, which includes leadership roles on numerous nonprofit boards with focus on strategic planning and sustainability.

Mark C. Kilmeris President of The Republic Companies, a family-owned group of businesses founded in 1916 and headquartered in Davenport, Iowa involved in the wholesale equipment and supplies distribution of energy management, electrical, refrigeration, heating, air-conditioning and sign support systems. Prior to joining The Republic Companies in 1984, Mr. Kilmer worked in the Management Information Systems Department of Standard Oil of California (Chevron) in San Francisco. Mr. Kilmer is currently the Chair of the Board of Directors of Quad City Bank and Trust, a board member of Genesis Health System, a member of the Board of Trustees of St. Ambrose University, and a former member of the Board of Directors of IMARK Group, Inc., a national member-owned purchasing cooperative of electric supplies and equipment distributors. He is a two-term past Chair of the PGA TOUR John Deere Classic and the past Chair of the Scott County YMCA’s Board of Directors. Mr. Kilmer is the past Chair of the Board of Directors of Genesis Medical Center and has served on the Board of Directors of the Genesis Heart Institute, St. Luke’s Hospital, Rejuvenate Davenport, the Vera French Foundation and Trinity Lutheran Church. He was a four-time project business consultant for Junior Achievement. Prior to joining the board of Quad City Bank and Trust in 1996, Mr. Kilmer served on the Board of Directors of Citizen’s Federal Savings Bank in Davenport, Iowa. In 2014, Mr. Kilmer was named the Outstanding Volunteer Fundraiser by the Quad City Chapter of the Association of Fundraising Professionals, and along with his wife, Kathy, received the Bethany Homes Leadership Family of the Year Award. In 2016, Mr. Kilmer and his wife were inducted into the Hall of Fame of the Handicapped Development Center.We consider Mr. Kilmer to be a qualified candidate for service on the board due to his experience as the President of a successful wholesale and supply distribution business in Davenport, Iowa, one of our market areas, prior service on a bank board and his knowledge of the business community in this area.the areas in which QCR Holdings operates.

10

| 10 |

Timothy B. O’Reillyisa graduate of Westminster College and University of Missouri - Kansas City School of Law. He has practiced law in Springfield, Missouri since 1995 and has served as a partner in the law firm of O’Reilly & Preston, LLC since 1999. He is also the CEO and Managing Partner of O’Reilly Hospitality Management, LLC, which he helped launch in 2007. A Missourian Award recipient in 2017, Mr. O’Reilly has led the hospitality company to numerous industry awards in the areas of guest service, sustainability, community outreach, design & construction and operations excellence under the franchise flags of Marriott, Hilton, IHG, and Choice,andHoulihan's Restaurants across the nation. Under Mr. O’Reilly’s leadership, O'Reilly Hospitality Management won the Springfield Business Journal Economic Impact Award in 2011 & 2018. He serves on several boards and holds leadership positions on the local and national level including Missouri Trust & Investment Company Board of Directors, Boys & Girls Club of Springfield Missouri Board of Directors, Chair of the Missouri Area Council for the Boys & Girls Club of America, the Choice Hotels International Cambria Hotels Owner Advisory Committee and the Houlihans Restaurants Franchise Advisory Board. We consider Mr. O’Reilly to be a qualified candidate for service on the board due to his legal education and experience, his business experience in hospitality finance, development and operations, and his knowledge of Springfield, Missouri, one of our market areas.

Donna J. Sorensen is President of Sorensen Consulting, a management consulting and executive coaching firm. Ms. Sorensen earned her undergraduate degree from Marycrest College and her Juris DoctorateDoctor degree from the University of Iowa College of Law. She has twenty years’ experience in trust and investment management serving as Executive Vice President Institutional Trust for U.S. Bank (formerly Firstar Bank) and she spent six years as President of SCI Pension Services, a pension administration and consulting company. Ms. Sorensen has served in leadership positions on numerous nonprofit boards in the Cedar Rapids community and for the University of Iowa where she taught in the Henry B. Tippie College of Business. She is a member of the Iowa State Bar Association. We consider Ms. Sorensen to be a qualified candidate for service on the board due to her experience as the President of a consulting firm in Iowa City, Iowa, her prior banking and wealth management experience, and her education and training as an attorney.

Marie Z. Ziegler is a retired Vice President and Deputy Financial Officer of Deere & Company and was previously the Vice President and Treasurer. She joined Deere & Company in 1978 as a consolidation accountant and held management positions in finance, treasury operations, strategic planning and investor and banking relations. Ms. Ziegler is a 1978 graduate of St. Ambrose University, with a bachelorBachelor of artsArts in accounting. She received her Certified Public Accountant designation in 1979, an MBA from the University of Iowa in 1985 and became a Board Leadership Fellow of the National Association of Corporate Directors in 2017. Ms. Ziegler is a memberVice-Chair of the Board of Directors for Royal Neighbors of America where sheand also serves on the Finance and theas Chair of its Investment Committees.Committee. She is on the boards of Riverbend Food Bank and the Quad Cities Community Foundation. Ms. Ziegler is Chairvice-chair of the Regional Development Authority where she serves on the Governance and Strategy Committees.River Bend Food Bank. She is also Vice Chair of Unity Point Health-Quad Cities, where she chairs the Quality and Cost of Care Committee and serves on the Executive Committee.Cities. She served as Chair of the Camp Liberty Capital Campaign for the Girl Scouts, Co-Chair of the Unity Point Birthplace campaign and is a past Chair of Trinity Health Enterprises.Enterprise. She recently joined the UnityPoint Health Board where she chairs the Investment Committee and serves on the Executive, Compensation and Venture Committees. Ms. Ziegler is the immediate past-Chair of the Regional Development Authority and former chair of the St. Ambrose University College of Business Alumni Advisory Council. She previously served on the following boards: United Way, John Deere Foundation, Quad Cities Community Foundation, Trinity Regional Health Systems, Trinity North Hospital/Trinity Medical Center, Mississippi Valley Girl Scout Council, Deere & Company Employees Credit Union, and the Two Rivers YMCA.University of Iowa College of Business Tippie Advisory Board. She is past-Chair of fundraising for Playcrafters Barn Theatre and a past memberpast-Chair of the UniversityTwo Rivers YMCA Board of Iowa College of Business’ Tippie Advisory Board.Trustees. In 2006 Ms. Ziegler was honored with a Quad City Athena Business Women’s Award and in 2016 was an Iowa Women’s Foundation honoree. Ms. Ziegler brings a broad knowledge of audit, risk and financial investment experience, all of which are valuable perspectives for the board. We consider Ms. Ziegler to be a qualified candidate for service on the board due primarily to the knowledge and experience regarding public companies she gained in her various roles at Deere & Company, as well as her involvement with a number of charitable organizations headquartered in communities served by QCR Holdings, providing her with business connections and extensive knowledge of our market areas.

11

| 11 |

CORPORATE GOVERNANCE AND THE BOARD OF DIRECTORS

General

Generally, the board oversees our business and monitors the performance of our management. In accordance with our corporate governance procedures, the board does not involve itself in the day-to-day operations of QCR Holdings, which is monitored by our executive officers and management. Our directors fulfill their duties and responsibilities by attending regular meetings of the full board, which are held no less frequently than quarterly. Our directors also discuss business and other matters with Mr. Helling, our Chief Executive Officer, other key executives and our principal external advisors (legal counsel, auditors and other consultants). The board is currently comprised of 12 directors. As a result of the proposed retirement of Mr. Baird, the board reduced the size of the board to 11 members effective at the 2022 Annual Meeting.

Directors Baird, Bates, Besong, Cobb, Field, Griesemer, Jacobs, Kilmer, Ralph, Peterson, O’Reilly, Sorensen, and Ziegler and nominee Jacobs are deemed to be “independent” according to the Nasdaq listing requirements, and the board has determined that thethese independent directors do not have other relationships with us that prevent them from making objective, independent decisions. Directors Helling and Gipple are not considered to be “independent” because they also serve as executive officers of either QCR Holdings or oneand certain of our subsidiaries.

During 2019,2021, the board of directors had an Audit Committee, a Risk Oversight Committee, a Nomination and Governance Committee, a Compensation Committee, and an Executive Committee. The current charters of these committees are available on our website at www.qcrh.com. Also posted on the website is general information regarding QCR Holdings and our common stock, many of our corporate polices (including our Corporate Governance Guidelines), and links to our filings with the Securities and Exchange Commission.

In 2019,2021, a total of sevenfour meetings were held by the boardBoard of directorsDirectors of QCR Holdings. All incumbent directors attended at least 75 percent of the meetings of the board and the committees on which they served during 2019.2021. Although we do not have a formal policy regarding director attendance at the annual meeting, we encourage our directors to attend. Last year, all of our directors were present atattended the virtual annual meeting.

12

| 12 |

Committees of the Board of Directors

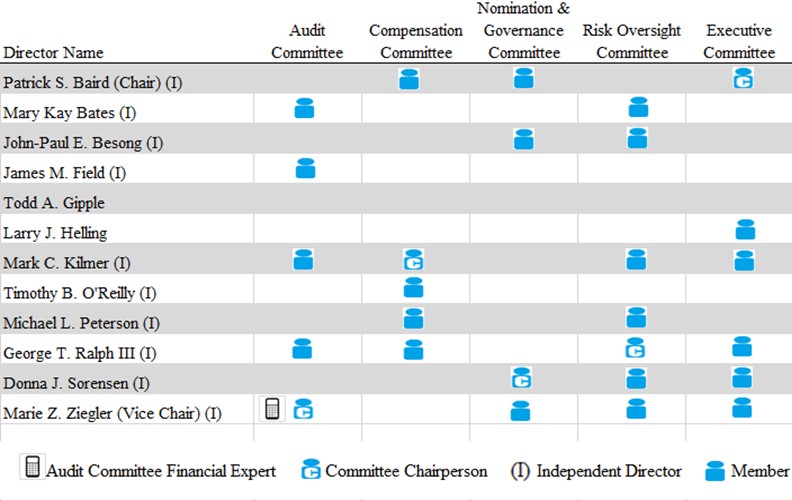

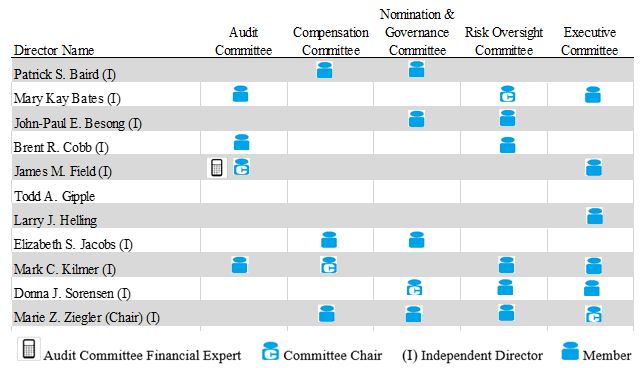

The composition of the board committees atas of December 31, 20192021 is shown in the following table:

Audit Committee. In 2019,2021, the Audit Committee consisted of directors Bates, Cobb, Field, (who joined in November 2019) Kilmer, Ralph and Ziegler.Ziegler (until May of 2021). Each of the members is considered “independent” pursuant to the Nasdaq listing requirements and the regulations of the Securities and Exchange Commission. The board of directors has determined that Ms. ZieglerMr. Field qualifies as an “Audit Committee Financial Expert” as that term is defined by the regulations of the Securities and Exchange Commission. The board based this decision on herhis professional experience including her service as Viceformer President and TreasurerChief Financial Officer of Deere & Company, and herhis educational experience, including having received a Certified Public Accountant designation.

The functions performed by the Audit Committee include, but are not limited to, the following:

| · | selecting our independent auditors and pre-approving all engagements and fee arrangements; |

| · | reviewing the independence of the independent auditors; |

| · | reviewing actions by management on recommendations of the independent auditors and internal auditors; |

| · | meeting with management, the internal auditors and the independent auditors to review the effectiveness of our system of internal control and internal audit procedures; |

| · | reviewing our earnings releases and reports filed with the Securities and Exchange Commission; and |

| · | reviewing reports of bank regulatory agencies and monitoring management’s compliance with recommendations contained in those reports. |

13

| 13 |

To promote the independence of the audit function, the Audit Committee consults separately and jointly with the independent auditors, the internal auditors and management. The Audit Committee has adopted a written charter, which sets forth its duties and responsibilities. The current charter of the Audit Committee is available on our website at www.qcrh.com. Ms. ZieglerMr. Field serves as Chair and Mr. RalphCobb serves as Vice Chair of the Audit Committee. The Audit Committee met five times during 2019.2021.

Compensation Committee. In 2019,2021, the Compensation Committee consisted of directors Baird, Jacobs, Kilmer, NeumanTimothy B. O’Reilly (until her retirementhis resignation in May)July of 2021), O’Reillyand Ziegler (beginning in May), Peterson and Ralph.May of 2021). Each of these directors is considered to be “independent” according to the Nasdaq listing requirements and a “non-employee” as defined in Section 16 of the Exchange Act. The purpose of the Compensation Committee is to determine the compensation to be paid to Mr. Helling, our Chief Executive Officer, and our other executive officers. The Compensation Committee reviews Mr. Helling’s performance and relies on Mr. Helling’s assessment of the performance of each of our other executive officers. Other members of senior management also provide the Compensation Committee with evaluations as to employee performance, guidance on establishing performance targets and objectives, and recommendations with respect to other compensation programs. The Compensation Committee also reviews and recommends to the board for approval other incentive compensation and equity compensation plans for QCR Holdings. The Compensation Committee’s responsibilities and functions are further described in its charter, which is available on our website at www.qcrh.com. Mr. Kilmer has servedserves as Chair of the Compensation Committee since May 2019. Linda Neuman served as Chair of the Compensation Committee prior to her retirement from the board in May 2019.Committee. The Compensation Committee met four times during 2019.2021.

Nomination and Governance Committee.In 2019,2021, the Nomination and Governance Committee consisted of directors Baird, Besong, Neuman (until her retirement in May),Jacobs, Sorensen, and Ziegler. Each of these directors is considered to be “independent” according to the Nasdaq listing requirements. The primary purposes of the Nomination and Governance Committee are to identify and recommend individuals to be presented to our stockholders for election or re-election to the board of directors and to review and monitor our policies, procedures and structure as they relate to corporate governance. We have adopted Corporate Governance Guidelines to assist our board in the exercise of its responsibilities. The responsibilities and functions of the committee are further described in its charter, which, along with the Corporate Governance Guidelines, is available on our website at www.qcrh.com. Ms. Sorensen serves as Chair and Mr. Besong serves as Vice Chair of the Nomination and Governance Committee. The Nomination and Governance Committee met four times during 2019.2021.

Risk Oversight Committee. In 2019,2021, the Risk Oversight Committee consisted of directors Bates, Besong, Bates,Cobb, Kilmer, Peterson, Ralph, Sorensen, and Ziegler. Each of these directors is considered to be “independent” according to the Nasdaq listing requirements. The Risk Oversight Committee is charged with being the primary board committee to actively monitor and oversee the risk management process. Additional information regarding risk oversight and the Risk Oversight Committee’s role is found on page 16.17 of this proxy statement. The responsibilities and functions are further described in its charter, which is available on our website at www.qcrh.com. Mr. RalphMs. Bates serves as Chair and Ms. ZieglerMr. Besong serves as Vice Chair of the Risk Oversight Committee. The Risk Oversight Committee met four times during 2019.2021.

Executive Committee.The Executive Committee consisted of directors Baird (until May 2021), Bates, Field (beginning in May 2021), Helling, Douglas M. Hultquist (until his retirement in May), Kilmer, Neuman (until her retirement in May), Ralph, Sorensen, and Ziegler. The Executive Committee is authorized to act with the same authority as the board of directors between meetings of the board, subject to certain limitations set forth in its charter. Although this authority allows the board to act quickly on matters requiring urgency when the full board is not available to meet, it is not intended to supplant the authority of the full board. The responsibilities and functions of the Executive Committee are further described in its charter, which is available on our website at www.qcrh.com. Mr. BairdMs. Ziegler serves as Chair and Ms. ZieglerMr. Field serves as Vice Chair of the Executive Committee. The Executive Committee met six timestwice during 2019.2021.

14

| 14 |

Consideration of Director Candidates

Director Nominations and Qualifications.For the 2020 annual meeting,2022 Annual Meeting, the Nomination and Governance Committee recommended for re-election to the board three of the four incumbent Class III directors whose terms are scheduled to expire in 2021,at the 2022 Annual Meeting. Mr. Baird, a Class II director since 2010, informed the committee that he would not seek reelection for an additional term as well as Elizabeth S. Jacobs,a director of QCR Holdings, and, accordingly, the committee did not re-nominate him for election at this year’s meeting. The committee decided not to seek a new candidatenominee for election to the board. Ms. Jacobs was generally identified by directorsdirector position being vacated, and management, including non-management directors, as a candidate for nomination toit will reevaluate the size of the board of directors for her over 40 years of experience in various private and public sectors, including the insurance and financial services industry.at future meetings. The board is currently comprised of 12 directors, but, as a result of the decision of Mr. Ralph and Mr. PetersonBaird to not stand for re-election at the annual meeting,2022 Annual Meeting, the size of the board will be reduced to 11 members as of the date of the annual meeting.2022 Annual Meeting. These nominations were approved by the full board. We did not receive any stockholder nominations for director for the 2020 annual meeting.2022 Annual Meeting.

In carrying out its nominating function, the Nomination and Governance Committee has developed qualification criteria for board membership. All potential nominees for election, including incumbent directors, board nominees and those stockholder nominees included in the proxy statement are reviewed for the following attributes:

| · | demonstrated integrity, ethics, reputation and character; |

| · | education, professional background and/or board experience relevant to the operation of QCR Holdings and service on the board; |

| · | evidenced leadership and sound business judgment in his or her professional life; |

| · | well recognized and demonstrated leadership of service to his or her community; and |

| · | willingness and ability to devote sufficient time to carrying out the duties and responsibilities required of a board member. |

The Nomination and Governance Committee also evaluates potential nominees to determine if they have any conflicts of interest that may interfere with their ability to serve as effective board members, to determine if they meet QCR Holdings’ age eligibility requirements (a person who has reached age 72 before the date of the annual meeting2022 Annual Meeting is not eligible for election to the board) and to determine whether they are “independent” in accordance with the Nasdaq listing requirements (to ensure that at least a majority of the directors will, at all times, be independent). The Nomination and Governance Committee considers the diversity of its directors and nominees in terms of knowledge, experience, skills, expertise, and other demographics which may contribute to the board. It has not, in the past, retained any third party to assist it in identifying candidates, but it has the authority to retain a third partythird-party firm or professional for the purpose of identifying candidates.

The Nomination and Governance Committee identifies nominees by first evaluating the current members of the board willing to continue in service whose term is scheduled to expire at the upcoming annual stockholder meeting to determine if those individuals satisfy the qualification criteria for continued membership on the board of directors. Prior to nominating an existing director for re-election to the board, it considers and reviews the following attributes with respect to each existing director:

| · | board and committee attendance and performance; |

| · | length of board service; |

| · | experience, skills and contributions that the existing director brings to the board; |

| · | independence and any conflicts of interest; and |

| · | any significant change in the existing director’s status, including the attributes considered for initial board membership. |

15

| 15 |

Current members of the board who satisfy the qualification criteria described above and who are willing to continue in service are considered for re-nomination. If any member of the board does not wish to continue in service or if the Nomination and Governance Committee or the board decides not to re-nominate a member for re-election, it would determine whether or not the position would be filled and, if so, would identify the desired skills and experience of a new nominee.

Board Diversity

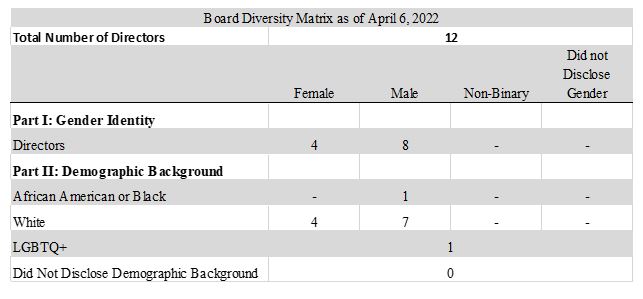

In August 2021, the Securities and Exchange Commission approved amendments to the listing rules of Nasdaq relating to board diversity and disclosure. The new Nasdaq listing rule requires all Nasdaq listed companies to disclose consistent, transparent diversity statistics regarding their boards of directors. The rules also require Nasdaq listed companies to have, or explain why they do not have, at least two diverse directors, including one who self-identifies as female and one who self-identifies as either an under-represented minority or LGBTQ+. Accordingly, we have surveyed members of our board of directors and concluded that the board is in compliance with Nasdaq’s diversity requirement. The Board Diversity Matrix below presents the board’s diversity statistics in the format prescribed by the new Nasdaq rule.

Code of Business Conduct and Ethics

We have a Code of Business Conduct and Ethics in place that applies to all of our directors and employees.employees, and all of these individuals receive annual training. The code sets forth the standard of ethics that we expect all of our directors and employees to follow, including our Chief Executive Officer and Chief Financial Officer. The code is posted on our website at www.qcrh.com. We have satisfied and intend to continue to satisfy the disclosure requirements under Item 5.05 of Form 8-K regarding any amendment to or waiver of the code with respect to our Chief Executive Officer, and Chief Financial Officer, and persons performing similar functions, by posting such information on our website.

Board Leadership Structure

Since January 1, 2007, we have kept the positions of Chair of the board of directors and Chief Executive Officer separate. While our bylaws do not require our Chair and Chief Executive Officer positions to be separate, the board believes that having separate positions and having an independent outside director serve as Chair is the appropriate leadership structure for QCR Holdings at this time and demonstrates our commitment to good corporate governance. Separating these positions allows our Chief Executive Officer to focus on our day-to-day business, while allowing the Chair to lead the board in its fundamental role of providing advice to, and exercising independent oversight of, management. We believe that having an independent Chair eliminates any conflicts of interest that could arise if the positions were held by one person. In addition, this leadership structure allows the board to more effectively monitor and evaluate the performance of our Chief Executive Officer.

| 16 |

Currently, Mr. BairdMs. Ziegler holds the position of Chair of the board of directors and Mr. Helling holds the position of Chief Executive Officer. Mr. BairdMs. Ziegler is considered to be “independent” according to the Nasdaq listing requirements.

To further enhance the role of the independent directors on our board and consistent with the Nasdaq listing requirements, the board’s independent directors regularly meet without Messrs. GippleHelling or HellingGipple in attendance.

The Board’s Role in Risk Oversight

While management is responsible for the day-to-day management of risks QCR Holdings faces, oversight of our risk management is central to the role of the board. The Risk Oversight Committee is charged with the primary responsibility for overseeing the risk management functions including those relating to operational (including information technology and cyber security aspects), legal/regulatory, capital, liquidity, interest rate, reputational and strategic risks, on behalf of the board. The members of the Risk Oversight Committee discuss our risk assessment and risk management policies, provide oversight, and inquire about significant risks and exposures, if any, and the steps taken to monitor and minimize such risks. As noted on page 14 of this proxy statement, the Risk Oversight Committee is composed of independent directors. The Risk Oversight Committee makes regular reports to the full board.

16

In addition, other board committees have been assigned oversight responsibility for specific areas of risk and risk management, and each committee considers risks within their areas of responsibility. The Audit Committee is responsible for monitoring our financial reporting process and system of internal controls, including controls related to risk management. The Compensation Committee is chiefly responsible for compensation-related risks. The members of the Compensation Committee discuss and review the key business and other risks we face and the relationship of those risks to certain compensation arrangements. This review is intended to comply with the Securities and Exchange Commission requirement to assess risks related to compensation plans and requirements of financial institution regulatory agencies (each as more fully described in the “Executive Compensation” section of this proxy statement). The subsidiary banks’ Loan Committees have primary responsibility for credit risk. For those subsidiary banks that have fiduciary powers, the banks’ Wealth Management Committees have primary responsibility for fiduciary risk. Each of these committees receives regular reports from management regarding oursuch risks and reports regularly to the Risk Oversight Committee or the full board concerning risk.such risks.

Environmental, Social and Governance Matters